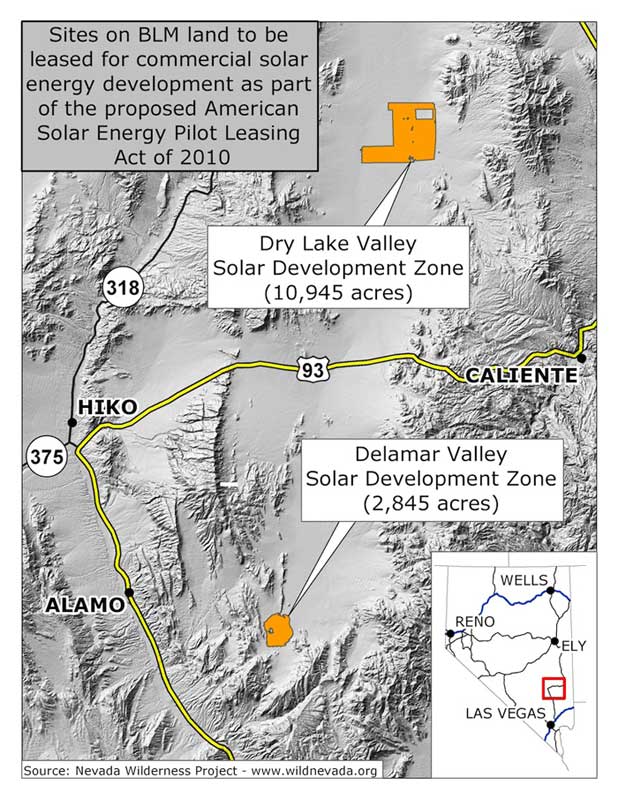

Solar Zones in Lincoln County, Nevada

June 16, 2010 - Senator Harry Reid (D-Nevada) and Representative Dean Heller (R-2nd Congressional District of Nevada) introduced companion bills to expedite leasing of public land to solar development. They are actually within Solar Energy Study Areas outlined in the Programmatic Draft Environmental Impact Statement for Solar Energy (due out this fall). Concerns are the amount of groundwater that might need to be pumped for any solar projects in these desert basins, as well as sensitive wildlife and plants in the areas. Environmentalists are in a tense battle with the Southern Nevada Water Authority’s plans to drain these two groundwater basins. (For more see the Great Basin Water Network.)

The Dry Lake Valley North solar zone is very close to special habitat for a rare rodent species: the Desert Valley kangaroo mouse (Microdipodops megacephalus albiventer).

While there is no direct suspension of environmental review under the National Environmental Policy Act (NEPA), the fact that the leases have to be issued within 60 days of passage, no meaningful NEPA or public input can be completed. The bill compromises NEPA. It declares that these areas must be designated zones before any NEPA review is completed -- a dangerous precedent.

The Reid Bill:

111TH CONGRESS

2D SESSION

S._____

To provide for the development of solar pilot project areas on public land

in Lincoln County, Nevada.

IN THE SENATE OF THE UNITED STATES

introduced the following bill; which was read twice

and referred to the Committee on

A BILL

To provide for the development of solar pilot project areas on public land in Lincoln County, Nevada.

Be it enacted by the Senate and House of Representatives of the United States of America in Congress assembled,

SECTION 1. SHORT TITLE.

This Act may be cited as the ‘‘American Solar Energy Pilot Leasing Act of 2010’’.

SEC. 2. DEFINITIONS.

In this Act:

(1) FEDERAL LAND.—The term ‘‘Federal land’’ means any of the Federal land in the State under the administrative jurisdiction of the Bureau of Land Management that is identified as a ‘‘solar development zone’’ on the maps.

(2) FUND.—The term ‘‘Fund’’ means the Renewable Energy Mitigation and Fish and Wildlife

Fund established by section 3(d)(5)(A).

(3) MAP.—The term ‘‘map’’ means each of—

(A) the map entitled ‘‘Dry Lake Valley Solar Development Zone’’ and dated May 25, 2010; and

(B) the map entitled ‘‘Delamar Valley Solar Development Zone’’ and dated May 25, 2010.

(4) SECRETARY.—The term ‘‘Secretary’’ means the Secretary of the Interior, acting through the Director of the Bureau of Land Management.

(5) STATE.—The term ‘‘State’’ means the State of Nevada.

SEC. 3. DEVELOPMENT OF SOLAR PILOT PROJECT AREAS ON PUBLIC LAND IN LINCOLN COUNTY, NEVADA.

(a) DESIGNATION.—In accordance with sections 201 and 202 of the Federal Land Policy and Management Act of 1976 (43 U.S.C. 1711, 1712) and subject to valid existing rights, the Secretary shall designate the Federal land as a solar pilot project area.

(b) APPLICABLE LAW.—The designation of the solar pilot project area under subsection (a) shall be subject to the requirements of—

(1) this Act;

(2) the Federal Land Policy and Management

Act of 1976 (43 U.S.C. 1701 et seq.); and

(3) any other applicable law (including regulations).

(c) SOLAR LEASE SALES.—

(1) INGENERAL.—The Secretary shall conduct lease sales and issue leases for commercial solar energy development on the Federal land, in accordance with this subsection.

(2) DEADLINE FOR LEASE SALES.—Not later than 60 days after the date of enactment of this Act, the Secretary, after consulting with affected governments and other stakeholders, shall conduct lease sales for the Federal land.

(3) EASEMENTS, SPECIAL-USE PERMITS, AND RIGHTS-OF-WAY.—Except for the temporary placement and operation of testing or data collection devices, as the Secretary determines to be appropriate, no new easements, special-use permits, or rights-of-way shall be allowed on the Federal land during the period beginning on the date of enactment of this Act and ending on the date of the issuance of a lease for the Federal land.

(4) DILIGENT DEVELOPMENT REQUIREMENTS.—In issuing a lease under this subsection,

the Secretary shall include work requirements and mandatory milestones—

(A) to ensure that diligent development is carried out under the lease; and

(B) to reduce speculative behavior.

(5) LAND MANAGEMENT.—The Secretary shall—

(A) establish the duration of leases issued under this subsection;

(B) include provisions in the lease requiring the holder of a lease granted under this

subsection—

(i) to furnish a reclamation bond or other form of security determined to be appropriate by the Secretary;

(ii) on completion of the activities authorized by the lease—

(I) to restore the Federal land that is subject to the lease to the condition in which the Federal land existed before the lease was granted; or

(II) to conduct mitigation activities if restoration of the land to the condition described in subclause (I) is impracticable; and

(iii) to comply with such other requirements as the Secretary considers necessary to protect the interests of the public and the United States; and

(C)(i) establish best management practices to ensure the sound, efficient, and environmentally responsible development of solar resources on the Federal land in a manner that would avoid, minimize, and mitigate actual and anticipated impacts to habitat and ecosystem function resulting from the development; and

(ii) include provisions in the lease requiring renewable energy operators to comply with the

practices established under clause (i).

(d) ROYALTIES.—

(1) INGENERAL.—The Secretary shall establish royalties, fees, rentals, bonuses, and any other payments the Secretary determines to be appropriate to ensure a fair return to the United States for any lease issued under this section.

(2) RATE.—Any lease issued under this section shall require the payment of a royalty established by the Secretary by regulation in an amount that is equal to a percentage of the gross proceeds from the sale of electricity at a rate that—

(A) encourages production of solar energy;

(B) ensures a fair return to the public comparable to the return that would be obtained on State and private land; and

(C) encourages the maximum energy generation practicable using the least amount of

land and other natural resources, including water.

(3) ROYALTY RELIEF.—To promote the maximum generation of renewable energy, the Secretary may provide that no royalty or a reduced royalty is required under a lease for a period not to exceed 5 years beginning on the date on which generation is initially commenced on the Federal land subject to the lease.

(4) DISPOSITION OF PROCEEDS.—

(A) IN GENERAL.—Of the amounts collected as royalties, fees, rentals, bonuses, or other payments under a lease issued under this section—

(i) 25 percent shall be paid by the Secretary of the Treasury to the State within the boundaries of which the income is derived;

(ii) 25 percent shall be paid by the Secretary of the Treasury to the 1 or more counties within the boundaries of which the income is derived;

(iii) 15 percent shall—

(I) for the period beginning on the date of enactment of this Act and ending on the date specified in sub-clause (II), be deposited in the Treasury of the United States to help facilitate the processing of renewable energy permits by the Bureau of Land Management in the State, subject to subparagraph (B)(i)(I); and

(II) beginning on the date that is 10 years after the date of enactment of this Act, be deposited in the Fund; and

(iv) 35 percent shall be deposited in the Fund.

(B) LIMITATIONS.—

(i) RENEWABLE ENERGY PERMITS.— For purposes of subclause (I) of subparagraph (A)(iii)—

(I) not more than $10,000,000 shall be deposited in the Treasury at any 1 time under that subclause; and

(II) the following shall be deposited in the Fund:

(aa) Any amounts collected under that subclause that are not obligated by the date specified in subparagraph (A)(iii)(II).

(bb) Any amounts that exceed the $10,000,000 deposit limit under subclause (I).

(ii) FUND.—Any amounts deposited in the Fund under clause (i)(II) or subparagraph (A)(iii)(II) shall be in addition to amounts deposited in the Fund under subparagraph (A)(iv).

(5) RENEWABLE ENERGY MITIGATION AND FISH AND WILDLIFE FUND.—

(A) ESTABLISHMENT.—There is established in the Treasury of the United States a fund, to be known as the ‘‘Renewable Energy Mitigation and Fish and Wildlife Fund’’, to be

administered by the Secretary, for use in the State.

(B) USE OF FUNDS.—Amounts in the Fund shall be available to the Secretary, who may, in the sole discretion of the Secretary, make the amounts available to the State or other interested parties for the purposes of—

(i) mitigating impacts of renewable energy on public land, including—

(I) protecting wildlife corridors and other sensitive land; and

(II) fish and wildlife habitat restoration; and

(ii) carrying out activities authorized under the Land and Water Conservation Fund Act of 1965 (16 U.S.C. 460l-4 et seq.).

(C) AVAILABILITY OF AMOUNTS.— Amounts in the Fund shall be available for expenditure, in accordance with this paragraph, without further appropriation, and without fiscal year limitation.

(D) INVESTMENT OF FUND.—

(i) IN GENERAL.—Any amounts deposited in the Fund shall earn interest in an amount determined by the Secretary of the Treasury on the basis of the current average market yield on outstanding marketable obligations of the United States of comparable maturities.

(ii) USE.—Any interest earned under clause (i) may be expended in accordance

with this paragraph.

The Heller Bill:

HR 5508 IH

111th CONGRESS

2d Session

H. R. 5508

To provide for the development of solar pilot project areas on public land in Lincoln County, Nevada.

IN THE HOUSE OF REPRESENTATIVES

June 10, 2010

Mr. HELLER introduced the following bill; which was referred to the Committee on Natural Resources.

A BILL To provide for the development of solar pilot project areas on public land in Lincoln County, Nevada.

Be it enacted by the Senate and House of Representatives of the United States of America in Congress assembled,

SECTION 1. SHORT TITLE.

This Act may be cited as the `American Solar Energy Pilot Leasing Act of 2010'.

SEC. 2. DEFINITIONS.

In this Act:

(1) COUNTY- The term `County' means Lincoln County, Nevada.

(2) FEDERAL LAND- The term `Federal land' means any of the Federal land in the State under the administrative jurisdiction of the Bureau of Land Management that is identified as a `solar development zone' on the maps.

(3) FUND- The term `Fund' means the Renewable Energy Mitigation and Fish and Wildlife Fund established by section 3(d)(5)(A).

(4) MAP- The term `map' means each of--

(A) the map entitled `Dry Lake Valley Solar Development Zone' and dated May 25, 2010; and

(B) the map entitled `Delamar Valley Solar Development Zone' and dated May 25, 2010.

(5) SECRETARY- The term `Secretary' means the Secretary of the Interior, acting through the Director of the Bureau of Land Management.

(6) STATE- The term `State' means the State of Nevada.

SEC. 3. DEVELOPMENT OF SOLAR PILOT PROJECT AREAS ON PUBLIC LAND IN LINCOLN COUNTY, NEVADA.

(a) Designation- In accordance with sections 201 and 202 of the Federal Land Policy and Management Act of 1976 (43 U.S.C. 1711, 1712) and subject to valid existing rights, the Secretary shall designate the Federal land as a solar pilot project area.

(b) Applicable Law- The designation of the solar pilot project area under subsection (a) shall be subject to the requirements of--

(1) this Act;

(2) the Federal Land Policy and Management Act of 1976 (43 U.S.C. 1701 et seq.); and

(3) any other applicable law (including regulations).

(c) Solar Lease Sales-

(1) IN GENERAL- The Secretary shall conduct lease sales and issue leases for commercial solar energy development on the Federal land, in accordance with this subsection.

(2) DEADLINE FOR LEASE SALES- Not later than 60 days after the date of enactment of this Act, the Secretary, after consulting with affected governments and other stakeholders, shall conduct lease sales for the Federal land.

(3) EASEMENTS, SPECIAL-USE PERMITS, AND RIGHTS-OF-WAY- Except for the temporary placement and operation of testing or data collection devices, as the Secretary determines to be appropriate, and the rights-of-way granted under section 301(b)(1) of the Lincoln County Conservation, Recreation, and Development Act of 2004 (Public Law 108-424; 118 Stat. 2413) and BLM Case File N-78803, no new easements, special-use permits, or rights-of-way shall be allowed on the Federal land during the period beginning on the date of enactment of this Act and ending on the date of the issuance of a lease for the Federal land.

(4) DILIGENT DEVELOPMENT REQUIREMENTS- In issuing a lease under this subsection, the Secretary shall include work requirements and mandatory milestones--

(A) to ensure that diligent development is carried out under the lease; and

(B) to reduce speculative behavior.

(5) LAND MANAGEMENT- The Secretary shall--

(A) establish the duration of leases issued under this subsection;

(B) include provisions in the lease requiring the holder of a lease granted under this subsection--

(i) to furnish a reclamation bond or other form of security determined to be appropriate by the Secretary;

(ii) on completion of the activities authorized by the lease--

(I) to restore the Federal land that is subject to the lease to the condition in which the Federal land existed before the lease was granted; or

(II) to conduct mitigation activities if restoration of the land to the condition described in subclause (I) is impracticable; and

(iii) to comply with such other requirements as the Secretary considers necessary to protect the interests of the public and the United States; and

(C)(i) establish best management practices to ensure the sound, efficient, and environmentally responsible development of solar resources on the Federal land in a manner that would avoid, minimize, and mitigate actual and anticipated impacts to habitat and ecosystem function resulting from the development; and

(ii) include provisions in the lease requiring renewable energy operators to comply with the practices established under clause (i).

(d) Royalties-

(1) IN GENERAL- The Secretary shall establish royalties, fees, rentals, bonuses, and any other payments the Secretary determines to be appropriate to ensure a fair return to the United States for any lease issued under this section.

(2) RATE- Any lease issued under this section shall require the payment of a royalty established by the Secretary by regulation in an amount that is equal to a percentage of the gross proceeds from the sale of electricity at a rate that--

(A) encourages production of solar energy;

(B) ensures a fair return to the public comparable to the return that would be obtained on State and private land; and

(C) encourages the maximum energy generation practicable using the least amount of land and other natural resources, including water.

(3) ROYALTY RELIEF- To promote the maximum generation of renewable energy, the Secretary may provide that no royalty or a reduced royalty is required under a lease for a period not to exceed 5 years beginning on the date on which generation is initially commenced on the Federal land subject to the lease.

(4) DISPOSITION OF PROCEEDS-

(A) IN GENERAL- Of the amounts collected as royalties, fees, rentals, bonuses, or other payments under a lease issued under this section--

(i) 25 percent shall be paid by the Secretary of the Treasury to the State within the boundaries of which the income is derived;

(ii) 25 percent shall be paid by the Secretary of the Treasury to the 1 or more counties within the boundaries of which the income is derived;

(iii) 15 percent shall--

(I) for the period beginning on the date of enactment of this Act and ending on the date specified in subclause (II), be deposited in the Treasury of the United States to help facilitate the processing of renewable energy permits by the Bureau of Land Management in the State, subject to subparagraph (B)(i)(I); and

(II) beginning on the date that is 10 years after the date of enactment of this Act, be deposited in the Fund; and

(iv) 35 percent shall be deposited in the Fund.

(B) LIMITATIONS-

(i) RENEWABLE ENERGY PERMITS- For purposes of subclause (I) of subparagraph (A)(iii)--

(I) not more than $10,000,000 shall be deposited in the Treasury at any 1 time under that subclause; and

(II) the following shall be deposited in the Fund:

(aa) Any amounts collected under that subclause that are not obligated by the date specified in subparagraph (A)(iii)(II).

(bb) Any amounts that exceed the $10,000,000 deposit limit under subclause (I).

(ii) FUND- Any amounts deposited in the Fund under clause (i)(II) or subparagraph (A)(iii)(II) shall be in addition to amounts deposited in the Fund under subparagraph (A)(iv).

(5) RENEWABLE ENERGY MITIGATION AND FISH AND WILDLIFE FUND-

(A) ESTABLISHMENT- There is established in the Treasury of the United States a fund, to be known as the `Renewable Energy Mitigation and Fish and Wildlife Fund', to be administered by the Secretary, for use in the State.

(B) USE OF FUNDS- Amounts in the Fund shall be available to the Secretary, who may make the amounts available to the State or other interested parties for the purposes of--

(i) mitigating impacts of renewable energy on public land, with priority given to land affected by the solar development zones designated under this Act, including--

(I) protecting wildlife corridors and other sensitive land; and

(II) fish and wildlife habitat restoration; and

(ii) carrying out activities authorized under the Land and Water Conservation Fund Act of 1965 (16 U.S.C. 460l-4 et seq.) in the State.

(C) AVAILABILITY OF AMOUNTS- Amounts in the Fund shall be available for expenditure, in accordance with this paragraph, without further appropriation, and without fiscal year limitation.

(D) INVESTMENT OF FUND-

(i) IN GENERAL- Any amounts deposited in the Fund shall earn interest in an amount determined by the Secretary of the Treasury on the basis of the current average market yield on outstanding marketable obligations of the United States of comparable maturities.

(ii) USE- Any interest earned under clause (i) may be expended in accordance with this paragraph.

(e) Priority Development-

(1) IN GENERAL- Within the County, the Secretary shall give highest priority consideration to implementation of the solar lease sales provided for under this Act.

(2) EVALUATION- The Secretary shall evaluate other solar development proposals in the County not provided for under this Act in consultation with the State, County, and other interested stakeholders.

END